Hourly wage tax calculator 2020

The tax rate ranges from 0 all the way up to 37. X Hourly wage Annual minimum Salary Minimum wage rates list in Ontario for 2022.

What Are Marriage Penalties And Bonuses Tax Policy Center

FICA stands for Federal Insurance Contributions Act and it collects two taxes that both employees and employers have to pay.

. Calculate your Weekly take home pay based of your Weekly salary to see full calculations for Pay As You Earn PAYE National Insurance Contributions NICs Employer National Insurance Contributions ENICs Pension Dividend tax etc. What is the hourly minimum wage in Ontario. Nunavut has the highest at 16 per hour.

Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. What is the average annual salary in Ontario. The hourly minimum wage in Ontario is 1500.

Calculate the FUTA Tax. 13-0000 Business and Financial Operations. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less.

The median annual wage for registered nurses was 77600 in May 2021. These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Indiana. 35000 40-hr week.

Checked for accuracy on 562022. Major Occupational Groups Note--clicking a link will scroll the page to the occupational group. Minimum wage of 875 per hour is the lowest amount a non-exempt employee in West Virginia can legally be paid for hourly work.

Special minimum wage rates such as the West Virginia waitress minimum wage for tipped employees may. The latest tax information from 2022 is used to show you exactly what you need to know. The median hourly wage for childcare workers was 1322 in May 2021.

The median annual wage for computer programmers was 93000 in May 2021. More information about the calculations performed. Wisconsins state minimum wage rate is 725 per hourThis is the same as the current Federal Minimum Wage rate.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in. Français Home page calculator and conversion.

The California minimum wage was last. Employment of childcare workers is projected to grow 8 percent from 2020 to 2030 about as fast as the average for all occupations. Median household income in 2020 was 67340.

The 2022 Weekly Pay Tax Calculator calculates your take home pay based on your Weekly Salary. These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Georgia. Hourly rates weekly pay and bonuses are also catered for.

The lowest 10 percent earned less than 76840 and the highest 10 percent earned more than 164590. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The latest budget information from April 2022 is used to show you exactly what you need to know.

Annual salary calculator tool compared to the minimum wage in Ontario for 2022. Californias state minimum wage rate is 1400 per hourThis is greater than the Federal Minimum Wage of 725. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in.

In 2022 the lowest minimum wage is 1181 per hour in Saskatchewan. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in.

In 2022 the lowest minimum wage is 1181 per hour in Saskatchewan. 2020 Hourly Minimum Wage. Federal Filing Status Federal Filing Status of Federal Allowances.

Why not find your dream salary too. You are entitled to be paid the higher state minimum wage. Sales tax calculator GST QST 2020.

2 Annual wages have been calculated by multiplying the hourly mean wage by a year-round full-time hours figure of 2080 hours. For those occupations where there is not an hourly wage published the annual wage has been directly calculated from. These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Oregon.

About 150300 openings for childcare workers are projected each year on average over the decade. Yearly Minimum Wage 2. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages is available in the downloadable XLS file. Free for personal use.

Nunavut has the highest at 16 per hour. The Wisconsin minimum wage was last changed in 2008 when it was raised 075 from 650. More information about the calculations performed is available on the about page.

You can find all the minute details in the IRS Publication 15-T. Hourly rates and weekly pay are also catered for. The minimum wage applies to most employees in Wisconsin with limited exceptions including tipped employees some student workers and other exempt occupations.

The lowest 10 percent earned less than 47560 and the highest 10 percent earned more than 155240. The hourly minimum wage in Canada varies from province to province so where you live plays a big role in how much you will earn. Social Security and Medicare.

The minimum wage is set at a provincial level so discrepancies exist in Canada. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. Reverse Québec sales tax calculator 2020.

About 194500 openings for registered nurses are projected each year on average over the decade. Reverse Québec sales tax calculator 2020. Net weekly income Hours of work per week Net hourly wage.

The median annual wage for pharmacists was 128570 in May 2021. The minimum wage applies to most employees in California with limited exceptions including tipped employees some student workers and other exempt occupations. Sales tax calculator HST GST 2020.

Weekly Minimum Wage 1. The Salary Calculator tells you monthly take-home or annual earnings considering Federal Income Tax Social Security and State Tax. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year.

Numerical values are consistent with living wage 2021 estimates published on 51222. While the minimum wage sets an earnings threshold under which our society is unwilling to let families slip it fails to ap. Sales tax calculator HST GST.

Employment of registered nurses is projected to grow 9 percent from 2020 to 2030 about as fast as the average for all occupations. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Sales tax calculator GST QST 2020.

Payroll Tax Calculator For Employers Gusto

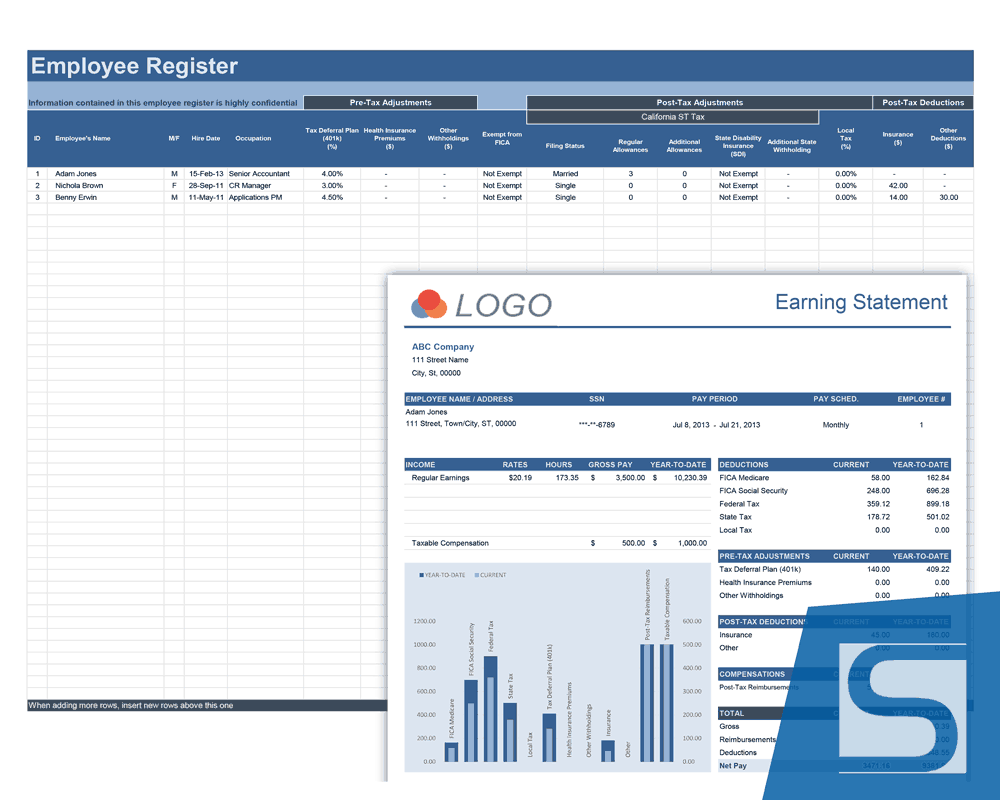

Payroll Calculator Free Employee Payroll Template For Excel

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Paycheck Calculator Take Home Pay Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Effective Tax Rate Formula Calculator Excel Template

Tip Tax Calculator Primepay

Gross Pay And Net Pay What S The Difference Paycheckcity

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

New York Paycheck Calculator Smartasset